As part of our card rating process, Forbes Advisor evaluates over 400 credit cards within their respective categories, including cash-back credit cards, travel cards, flexible rewards cards, business credit cards, student cards and cards with 0% APR offers.

For each card, we gathered information that potential cardholders would use in their decision-making process, including:

- Annual fees

- Reward earning rates and values

- Welcome bonuses

- Interest rates and/or promotions

- Card benefits, credits and perks

- Consumer protections

Cards are weighed against others in their category according to which card characteristics are most important within that category. These scores allowed us to rank them based on their terms and features and select the top 10 credit cards of 2025 for this list.

Please note: Cards on this list may not be shown in order of their star rating. The star rating is determined solely by the editorial team.

See More of Our Best Credit Card Lists

Complete Guide to Credit Cards

- Best Credit Card Offers Right Now

- Types of Credit Cards in 2025

- What Credit Card Should I Get?

- How To Choose a Credit Card

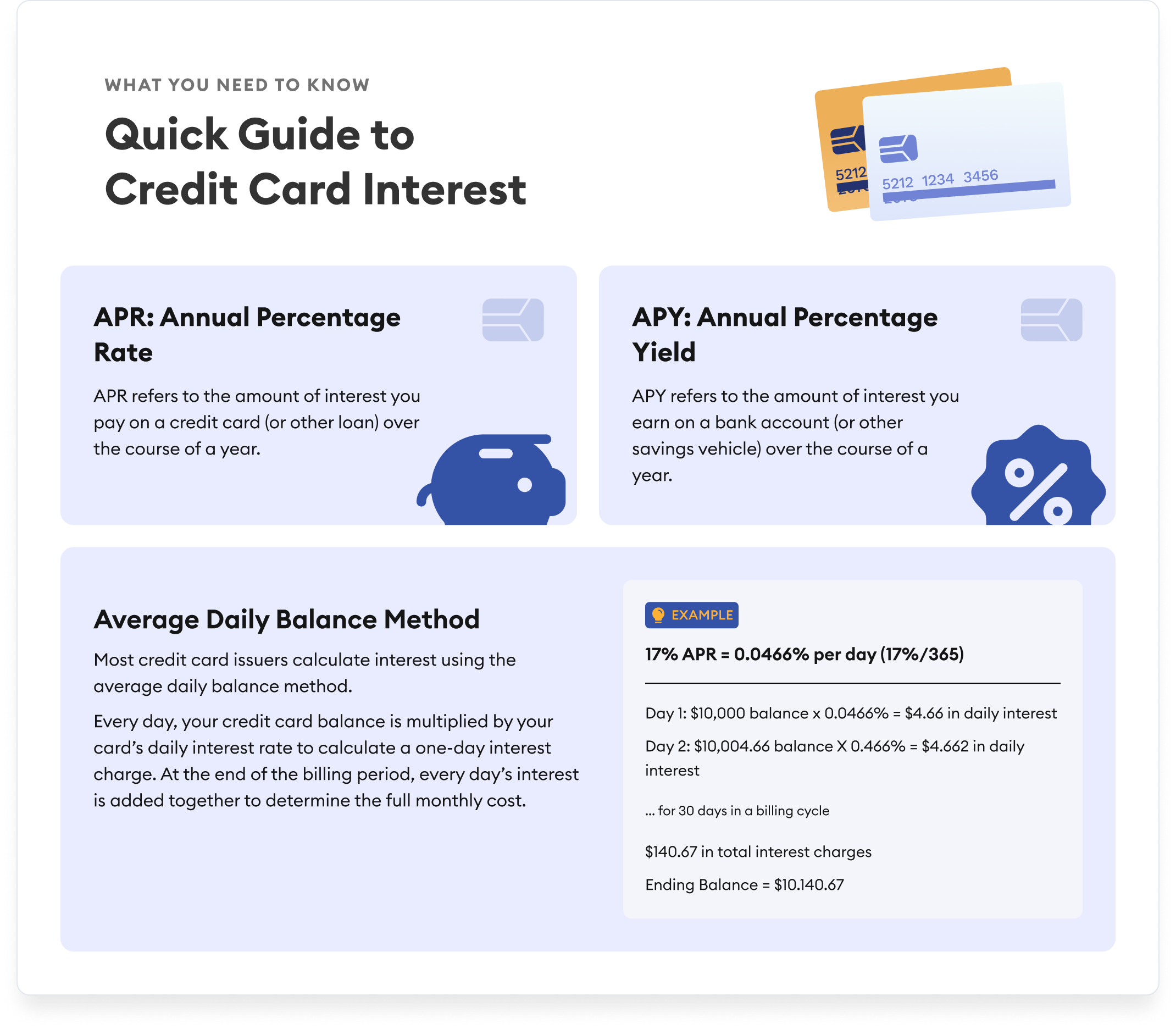

- How Does Credit Card Interest Work?

- How To Get the Most From Your Credit Card

- Top Credit Card Companies

- Best Credit Cards FAQs

Best Credit Card Offers Right Now

If you’re looking for a new credit card, you may want to know which ones have the highest-value welcome bonuses right now. This week, these cards have the highest credit card offers by category.

Keep in mind that annual fees and additional benefits will vary— often significantly—so weigh the pros and cons of a particular card beyond just the bonus before you apply. That can help you determine the best credit cards for your personal situation if you’re ready to add a new one to your wallet.

| Card Category | Card Name | Annual Fee | Welcome Offer |

|---|---|---|---|

| Best Overall Card Welcome Bonus | Marriott Bonvoy Boundless® Credit Card* | $95 | 3 Free Night Awards after spending $3,000 on eligible purchases in the first three months of account opening |

| Best Overall Card Welcome Bonus Runner-up | Avianca LifeMiles American Express Elite Card* | $249 | 60,000 miles after spending $4,500 in purchases in the first 90 days of account opening plus 40,000 miles after spending $25,000 in the first year |

| Best Airline Card Welcome Bonus | Avianca LifeMiles American Express Elite Card* | $249 | 60,000 miles after spending $4,500 in purchases in the first 90 days of account opening plus 40,000 miles after spending $25,000 in the first year |

| Best Hotel Card Welcome Bonus | Marriott Bonvoy Boundless® Credit Card* | $95 | 3 Free Night Awards after spending $3,000 on eligible purchases in the first three months of account opening |

| Best Flexible Rewards Card Welcome Bonus | $695 (Terms apply, see rates & fees) | 80,000 Membership Rewards Points after spending $8,000 on eligible purchases on the card in the first 6 months of card membership | |

| Best Cash Back Card Welcome Bonus | $0 | Discover will automatically match all the cash back earned at the end of the first year as a cardmember. There's no minimum spending or maximum rewards | |

| Best Intro APR Card Welcome Bonus | $0 | Unlimited match of all the miles earned at the end of the first year | |

| Best Balance Transfer Card Welcome Bonus | $0 | Unlimited match of all the miles earned at the end of the first year | |

| Best Student Card Welcome Bonus | Citi Rewards+® Student Card | $0 | 5,000 bonus points after spending $500 in the first 3 months of account opening |

| Best Business Card Welcome Bonus | $695 (Terms apply, see rates & fees) | 150,000 Membership Rewards® points after spending $20,000 in eligible purchases with the card within the first 3 months of card membership |

Methodology for Evaluating the Best Credit Card Welcome Offers

The best credit card deals for the week of January 20, 2025 were chosen based on the value of the welcome bonus, taking into account Forbes Advisor’s points and miles valuations for airline and hotel programs. Conduct informed research before deciding which cards will help you achieve your financial goals.